What if you can get a part-time job with a professional license (since you're image conscious)? All the better, if this endeavor is for free, affords you free classes, and is linked with government and private banking institutions?

Become a financial adviser, a financial analyst, or even a stock broker!

A 7-day basic training is all you need to get started.

Friday, January 31, 2014

Monday, January 27, 2014

Just Do it, Investment or Otherwise

Don't

doubt your self taking off. Year after year you will make it better.

With the awesome people around, failure is not imminent.

So why think "I can't start an investment because I might get unemployed."

"I can't risk it because I don't know what I'll be a year from now."

"I can't do it because things might change for the worse and I don't know when."

For Pete's sake don't be a loser and just do it!

Sunday, January 19, 2014

iPad Plan or iPad Cash Purchase?

Thinking of buying an iPad Air 32gb, wifi + 4G?

Which is cheaper: Postpaid or cash?

Here's a simple computation for you:

31300 (cash) vs 45800 (1700/month/24mos + 5k upfront cash)

Plan is 14500 more expensive.

You pay P604 extra per month for 24 months.

But plan comes with 65 hours of LTE so you might not have a need to pay for a separate wifi bill. In short, you save by purchasing it via plan.

And if you put your unspent cash in equity stocks (since you opted for a monthly payment) then in two years you would already have reached a break-even.

~your financial adviser

PS

I took my own advice.

Which is cheaper: Postpaid or cash?

Here's a simple computation for you:

31300 (cash) vs 45800 (1700/month/24mos + 5k upfront cash)

Plan is 14500 more expensive.

You pay P604 extra per month for 24 months.

But plan comes with 65 hours of LTE so you might not have a need to pay for a separate wifi bill. In short, you save by purchasing it via plan.

And if you put your unspent cash in equity stocks (since you opted for a monthly payment) then in two years you would already have reached a break-even.

~your financial adviser

PS

I took my own advice.

Saturday, January 11, 2014

A Better Alternative to SSS and GSIS

Not a few Filipino citizens will be looking forward to their monthly pension from SSS and GSIS upon retirement. And it is no secret that the allowance roughly translates to P3,000/month, which 10 years from now will just be equivalent to P1,809.

Do you think P1,809/month will suffice? How about your maintenance medicine? Your electric bill and other fixed expenses? What if you would need a lump sum amount for a surgery?

Clearly, a small trickle of allowance from SSS or GSIS will not be sufficient.

What if there's a solution that can afford you a P15,000 monthly pension instead? A solution that allows you to withdraw P1.6M tax-free should you need a lumpsum?

I'm talking about investments. Of course it's better if you have an insurance policy. But let's go back to how this will work.

1) You are 35 years old today.

2) You want P1.6M at age 55 OR P15,000 monthly earnings from 55th year onwards

3) You want to be able to partially withdraw cash anytime

4) You don't like the idea of maturity dates

What do you have to do?

1. Save P1600 for 20 years. Stick to it.

2. Save it in high earnings stocks.

Other Options:

If you save P1600 in the piggy bank, you will get P384,000 in 20 years.

If you save it in time deposit, you will get P501,000 in 20 years.

If you save in stocks and bonds, you will get P1.6 million.

Which would you choose?

You've got to plan for your future self. And you can start now.

-------------------------------

For inquiries, send an email to Horeb Eliot at horebelliot at yahoo .com.

Horeb Eliot is an assistant professor at UP and is a licensed financial planner.

Do you think P1,809/month will suffice? How about your maintenance medicine? Your electric bill and other fixed expenses? What if you would need a lump sum amount for a surgery?

Clearly, a small trickle of allowance from SSS or GSIS will not be sufficient.

What if there's a solution that can afford you a P15,000 monthly pension instead? A solution that allows you to withdraw P1.6M tax-free should you need a lumpsum?

I'm talking about investments. Of course it's better if you have an insurance policy. But let's go back to how this will work.

1) You are 35 years old today.

2) You want P1.6M at age 55 OR P15,000 monthly earnings from 55th year onwards

3) You want to be able to partially withdraw cash anytime

4) You don't like the idea of maturity dates

What do you have to do?

1. Save P1600 for 20 years. Stick to it.

2. Save it in high earnings stocks.

Other Options:

If you save P1600 in the piggy bank, you will get P384,000 in 20 years.

If you save it in time deposit, you will get P501,000 in 20 years.

If you save in stocks and bonds, you will get P1.6 million.

Which would you choose?

You've got to plan for your future self. And you can start now.

-------------------------------

For inquiries, send an email to Horeb Eliot at horebelliot at yahoo .com.

Horeb Eliot is an assistant professor at UP and is a licensed financial planner.

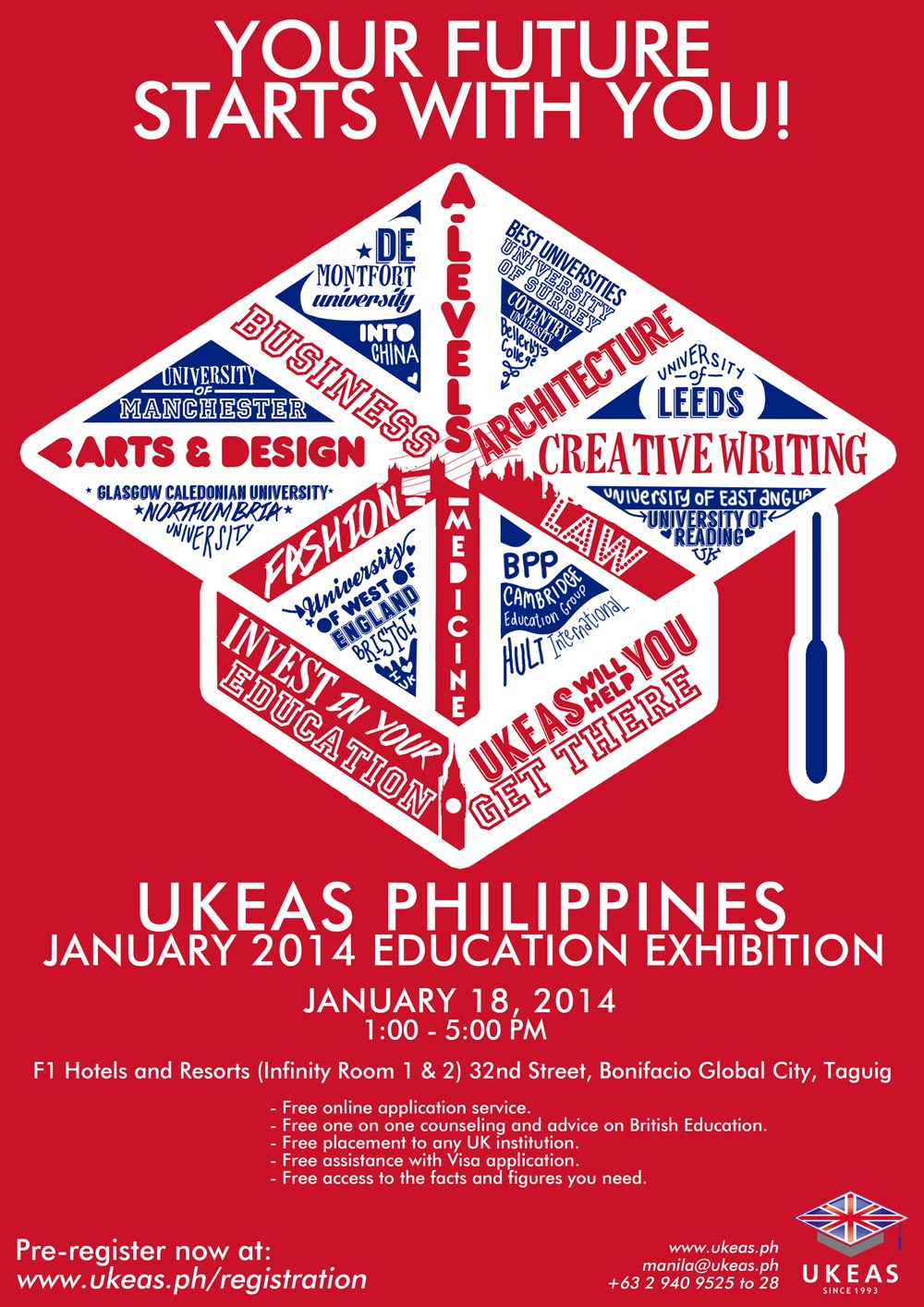

Study in the UK

Friday, January 10, 2014

What Keeps you from Investing?

I really find investment exciting and rewarding (Colfinancial, Philam). I wonder about people's general reasons why they aren't:

A) break even salary; nothing to save at all

B) lack of information about investment

C) does now know someone to provide reliable assistance

D) fear of doing something new

Irrespective of whatever reasons you identify above, I believe all of them can be solved by sound financial planning.

----------------------

Please feel free to send inquiries to the author at horebelliot @ yahoo . com.

Horeb Eliot is an assistant professor of Political Science at UPLB and a licensed financial adviser.

A) break even salary; nothing to save at all

B) lack of information about investment

C) does now know someone to provide reliable assistance

D) fear of doing something new

Irrespective of whatever reasons you identify above, I believe all of them can be solved by sound financial planning.

----------------------

Please feel free to send inquiries to the author at horebelliot @ yahoo . com.

Horeb Eliot is an assistant professor of Political Science at UPLB and a licensed financial adviser.

Thursday, January 9, 2014

Tomato Paste Facial Mask

The ~ber months gave another nasty round of acne bloom, which aren't really welcome Christmas additions. The choco-honey-red wine face mask that I have been using to keep my pimples at bay failed to work this time, to my heart's disappointment, and so I had to look for an alternative mask.

I used cherry tomatoes before in Korea and my face has never been that clear. I thought it was just the good weather and non-greasy foods so I decided to just treat tomatoes as a fruit, or vegetable, whatever.

Bad move. My pimples recurred. Back to slathering squished tomatoes on my face. It was troublesome, especially if the juice runs down to my clothes. And so I got enough of the tomato regimen and onto the chocolate-honey-red wine alternative.

I've been using that mask for almost a year now, but there has been no real effect on my face. So, just a week ago, I decided to give tomatoes once again a try. I bought a pack of tomato paste because I reckon it's gonna be less drippy. It tingles a bit because I didn't dilute the paste with anything in the initial attempt. I wanted to clear up the acne marks quickly, and I assume that tomatoes have natural acids that will do the thing. Yes, it did tingle, and so it must be working.

Now, down to the 7th day of using it.

Pores were definitely smaller! Dark marks left by red, cystic acne were significantly less visible, and my facial complexion noticeably lightened. Seriously, I cannot believe that I had just saved thousands of pesos for an IPL or diamond peel just to get rid of these unsightly genetic curses once and for all.

If you have oily skin, don't dilute the tomato paste with anything. It'll work faster that way, I think. If your skin is sensitive, put a little bit of honey to the mix. Let it sit on your skin for more than an hour, yeah! Sometimes I leave it on till I finish a whole movie. Rinse, moisturize, and off you go to bed. Your face will be as bright as the morning sunshine.

The lovely red plushies saved the day.

I used cherry tomatoes before in Korea and my face has never been that clear. I thought it was just the good weather and non-greasy foods so I decided to just treat tomatoes as a fruit, or vegetable, whatever.

Bad move. My pimples recurred. Back to slathering squished tomatoes on my face. It was troublesome, especially if the juice runs down to my clothes. And so I got enough of the tomato regimen and onto the chocolate-honey-red wine alternative.

I've been using that mask for almost a year now, but there has been no real effect on my face. So, just a week ago, I decided to give tomatoes once again a try. I bought a pack of tomato paste because I reckon it's gonna be less drippy. It tingles a bit because I didn't dilute the paste with anything in the initial attempt. I wanted to clear up the acne marks quickly, and I assume that tomatoes have natural acids that will do the thing. Yes, it did tingle, and so it must be working.

Now, down to the 7th day of using it.

Pores were definitely smaller! Dark marks left by red, cystic acne were significantly less visible, and my facial complexion noticeably lightened. Seriously, I cannot believe that I had just saved thousands of pesos for an IPL or diamond peel just to get rid of these unsightly genetic curses once and for all.

If you have oily skin, don't dilute the tomato paste with anything. It'll work faster that way, I think. If your skin is sensitive, put a little bit of honey to the mix. Let it sit on your skin for more than an hour, yeah! Sometimes I leave it on till I finish a whole movie. Rinse, moisturize, and off you go to bed. Your face will be as bright as the morning sunshine.

The lovely red plushies saved the day.

Tuesday, January 7, 2014

Helping and unconditionally giving to your family could be harmful in the long run

You

have to hold on to your dreams, even if you support your family. You do

this not by holding them as a fantasy, but by taking practical steps to

make them a reality. (modified)

This is a gem I picked from Suze Orman's book The Laws of Money, The Lessons of Life, to which I owe my family's relative financial stability (as of 2013!). I hope more people, especially those with loving intentions to labor and send their siblings to school and pay for loans their relatives owe, wear around their neck.

Please do not think that you're becoming unselfish by giving and giving. The truth is, if you fail to protect and secure your self, you may just end up becoming another liability, if not a casualty, of your own good intentions.

A balancing act, then, is required.

This is a gem I picked from Suze Orman's book The Laws of Money, The Lessons of Life, to which I owe my family's relative financial stability (as of 2013!). I hope more people, especially those with loving intentions to labor and send their siblings to school and pay for loans their relatives owe, wear around their neck.

Please do not think that you're becoming unselfish by giving and giving. The truth is, if you fail to protect and secure your self, you may just end up becoming another liability, if not a casualty, of your own good intentions.

A balancing act, then, is required.

Sunday, January 5, 2014

Half a Million Peso Challenge

I received a request to modify the Php 2000 savings to Php 1000 and project the total balance in 15 years.

The good news is, typical stocks allow for a minimum of P1000 deposit at any point in time and at any frequency, so long as you have extra cash.

So, here's the 15-year projection:

That's a total deposit of 180k and total balance of 476k.

Know where to put your hard earned cash in safe and high-yielding destinations.

----------

For inquiries, kindly send an email to the author at horebelliot at yahoo.com

The good news is, typical stocks allow for a minimum of P1000 deposit at any point in time and at any frequency, so long as you have extra cash.

So, here's the 15-year projection:

That's a total deposit of 180k and total balance of 476k.

Know where to put your hard earned cash in safe and high-yielding destinations.

----------

For inquiries, kindly send an email to the author at horebelliot at yahoo.com

Saturday, January 4, 2014

Saving Thought-Strategy

I am currently reading Suze Orman's books and came across this gem of an idea, which we know anyway but tend to ignore:

"Just because you can afford it doesn't mean you should buy it."

iPhone plans are cheap in the Philippines. You can get an LG G2 unit with unlimited data and hours of call-time at 41U$D a month. Clothes are relatively affordable with Guess and Bershka averaging 55U$D per article.

Indeed, temptations are everywhere. But when you wear that little advice around your neck, and recognize that your 50USD (P2000.00), if invested instead, say, in mutual funds or UITFs, can make you financially secure in the long-term, then deferring gratification will come in easy.

"Just because you can afford it doesn't mean you should buy it."

iPhone plans are cheap in the Philippines. You can get an LG G2 unit with unlimited data and hours of call-time at 41U$D a month. Clothes are relatively affordable with Guess and Bershka averaging 55U$D per article.

Indeed, temptations are everywhere. But when you wear that little advice around your neck, and recognize that your 50USD (P2000.00), if invested instead, say, in mutual funds or UITFs, can make you financially secure in the long-term, then deferring gratification will come in easy.

Friday, January 3, 2014

First One (1) Million Peso Savings Challenge!

Getting your first million is pretty straight foward. Save up P2,000 in high yielding, SEC (Securities and Exchange Commission) regulated investment instruments and get your first P1 million in 15 years. You'll see that the total interest earnings amount to P636,598, which means that the total deposits you've made is equivalent to 370,000.

Did you money just get doubled? Remember: It takes 15 years because this form of investment is a safe way to go. Filipinos usually get scammed because of promises of high yields, short time, low risk combinations. Obviously, there is no get rich quick scheme.

If you want to know more about savings and investment alternatives to:

1. Savings account

2. UITF

3. Time Deposits

feel free to send the author an email.

-------

Horeb Eliot is a licensed financial planner and professor of Political Science (International Affairs).

MERALCO Electricity Hike for December

I think our government failed to take the best interest of the country

at heart. Instead, it relied absolutely on IPPs for power supply. Where

do we find ourselves currently?

The Supreme Court's TRO will eventually evaporate because the government doesn't know what to do if the IPPs scale down electricity supply. There's a reason why they're called 'independent'.

I think we will have to pay anyway albeit in smaller installments this humongous kilowatt per hour increase. TRO is just what it is--temporary.

Here's a link to a band aid solution from the Supreme Court. Thanks to Bayan Muna. We should elect more of them!

The Supreme Court's TRO will eventually evaporate because the government doesn't know what to do if the IPPs scale down electricity supply. There's a reason why they're called 'independent'.

I think we will have to pay anyway albeit in smaller installments this humongous kilowatt per hour increase. TRO is just what it is--temporary.

Here's a link to a band aid solution from the Supreme Court. Thanks to Bayan Muna. We should elect more of them!

Wednesday, January 1, 2014

Starting the Year with a Poem

The Morning Instance

When the heart troubles the mind

Is like a nighttime sky color-streaked by rushing meteorites

That the logic and nightmare from elvish stories

Seem to seep into reality

Of challenges, heartbreaks, and wuthering lies.

To me, when the heart troubles the mind,

Is like a painful catharsis of self-reflection

Which feels just like that morning instance

When the sun rises and hurts your eyes.

When you have to open it nonetheless, and be hurt even more.

And more until you get used to

And sip the confusion of

Logic and reality, heartbreaks and hopes

Of quenching the old and the uncertainty of the new.

/Eliot

When the heart troubles the mind

Is like a nighttime sky color-streaked by rushing meteorites

That the logic and nightmare from elvish stories

Seem to seep into reality

Of challenges, heartbreaks, and wuthering lies.

To me, when the heart troubles the mind,

Is like a painful catharsis of self-reflection

Which feels just like that morning instance

When the sun rises and hurts your eyes.

When you have to open it nonetheless, and be hurt even more.

And more until you get used to

And sip the confusion of

Logic and reality, heartbreaks and hopes

Of quenching the old and the uncertainty of the new.

/Eliot

2014 Call for a Better World

Kindness is free.

Sprinkle that shit everywhere!

For more kindness, empathy, and other-centeredness this 2014!

Sprinkle that shit everywhere!

For more kindness, empathy, and other-centeredness this 2014!

Subscribe to:

Posts (Atom)

sEntry: The Clutter Junkster

Korea-related posts:

Dedication Post

1) Creature of Habit

2) Hope for Joy

3) Frozen in Time

4) Precious Wound

5) Ironed Fashion

6) My Name is Rain

7) Winning Moment

8) Life on Film

9) I Can't Touch the Things that are True

10) Kaleidoscopic Bibimbapish Post

Post-Korea Stress Syndrome

1) Time in a Bottle

2) For a While

3) Still Single

4) Thesis Acknowledgments

5) A Tribute to the Triad

6) Prince Caspian: A Must See

7) Halo-halo for the Rainy Days

8) Family Reunion

9) Lying is A By-product

10) Gladiators in My Dream

11) Turning a New Leaf

12) Is There a Bane to Being Brown?

13) Serve the People?

14) Lament of a Call Center Agent

15) A Mechalife

Bpath Counter

Dedication Post

1) Creature of Habit

2) Hope for Joy

3) Frozen in Time

4) Precious Wound

5) Ironed Fashion

6) My Name is Rain

7) Winning Moment

8) Life on Film

9) I Can't Touch the Things that are True

10) Kaleidoscopic Bibimbapish Post

Post-Korea Stress Syndrome

1) Time in a Bottle

2) For a While

3) Still Single

4) Thesis Acknowledgments

5) A Tribute to the Triad

6) Prince Caspian: A Must See

7) Halo-halo for the Rainy Days

8) Family Reunion

9) Lying is A By-product

10) Gladiators in My Dream

11) Turning a New Leaf

12) Is There a Bane to Being Brown?

13) Serve the People?

14) Lament of a Call Center Agent

15) A Mechalife

Bpath Counter