Not a few Filipino citizens will be looking forward to their monthly pension from SSS and GSIS upon retirement. And it is no secret that the allowance roughly translates to P3,000/month, which 10 years from now will just be equivalent to P1,809.

Do you think P1,809/month will suffice? How about your maintenance medicine? Your electric bill and other fixed expenses? What if you would need a lump sum amount for a surgery?

Clearly, a small trickle of allowance from SSS or GSIS will not be sufficient.

What if there's a solution that can afford you a P15,000 monthly pension instead? A solution that allows you to withdraw P1.6M tax-free should you need a lumpsum?

I'm talking about investments. Of course it's better if you have an insurance policy. But let's go back to how this will work.

1) You are 35 years old today.

2) You want P1.6M at age 55 OR P15,000 monthly earnings from 55th year onwards

3) You want to be able to partially withdraw cash anytime

4) You don't like the idea of maturity dates

What do you have to do?

1. Save P1600 for 20 years. Stick to it.

2. Save it in high earnings stocks.

Other Options:

If you save P1600 in the piggy bank, you will get P384,000 in 20 years.

If you save it in time deposit, you will get P501,000 in 20 years.

If you save in stocks and bonds, you will get P1.6 million.

Which would you choose?

You've got to plan for your future self. And you can start now.

-------------------------------

For inquiries, send an email to Horeb Eliot at horebelliot at yahoo .com.

Horeb Eliot is an assistant professor at UP and is a licensed financial planner.

Saturday, January 11, 2014

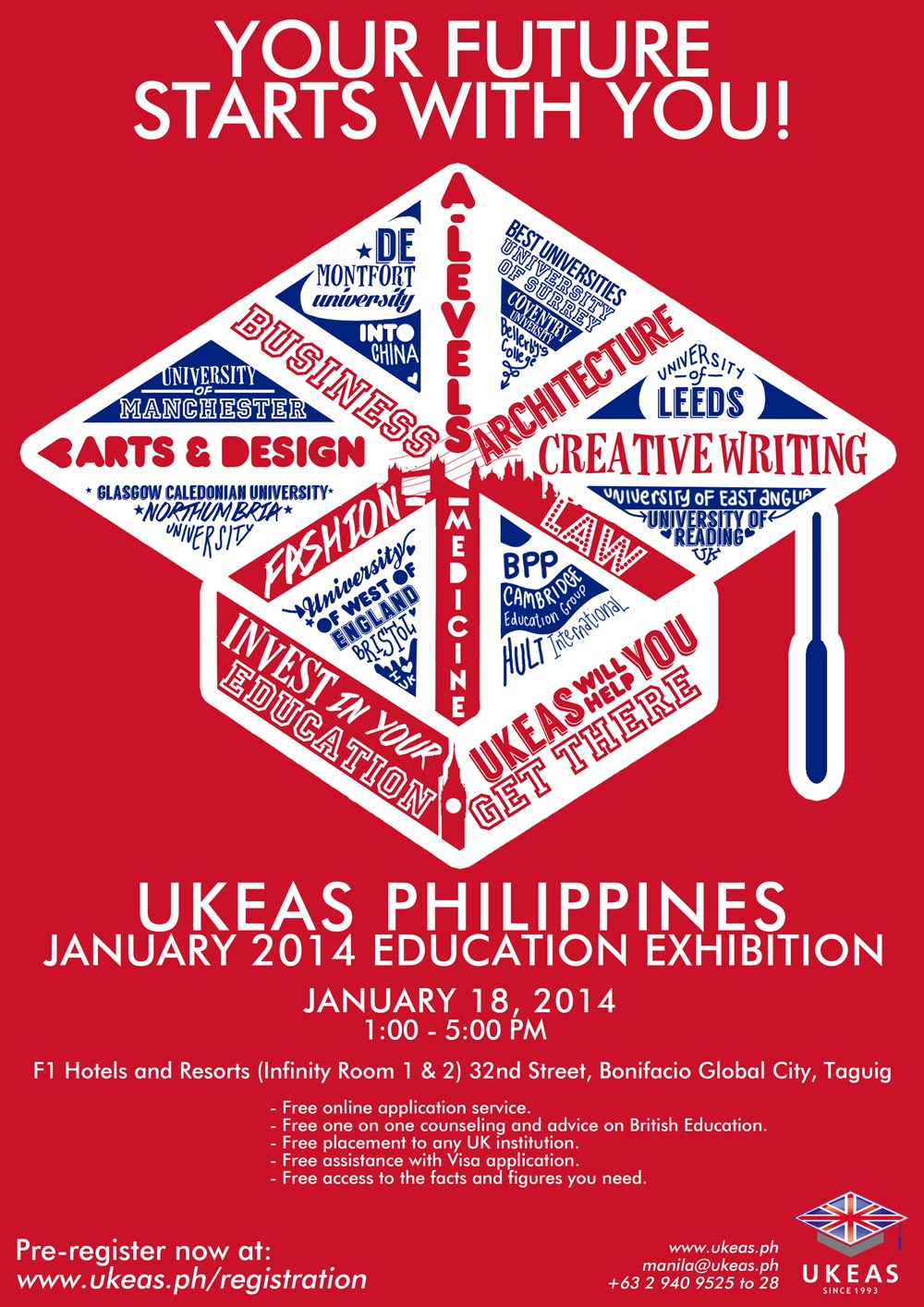

Study in the UK

Subscribe to:

Comments (Atom)

sEntry: The Clutter Junkster

Korea-related posts:

Dedication Post

1) Creature of Habit

2) Hope for Joy

3) Frozen in Time

4) Precious Wound

5) Ironed Fashion

6) My Name is Rain

7) Winning Moment

8) Life on Film

9) I Can't Touch the Things that are True

10) Kaleidoscopic Bibimbapish Post

Post-Korea Stress Syndrome

1) Time in a Bottle

2) For a While

3) Still Single

4) Thesis Acknowledgments

5) A Tribute to the Triad

6) Prince Caspian: A Must See

7) Halo-halo for the Rainy Days

8) Family Reunion

9) Lying is A By-product

10) Gladiators in My Dream

11) Turning a New Leaf

12) Is There a Bane to Being Brown?

13) Serve the People?

14) Lament of a Call Center Agent

15) A Mechalife

Bpath Counter

Dedication Post

1) Creature of Habit

2) Hope for Joy

3) Frozen in Time

4) Precious Wound

5) Ironed Fashion

6) My Name is Rain

7) Winning Moment

8) Life on Film

9) I Can't Touch the Things that are True

10) Kaleidoscopic Bibimbapish Post

Post-Korea Stress Syndrome

1) Time in a Bottle

2) For a While

3) Still Single

4) Thesis Acknowledgments

5) A Tribute to the Triad

6) Prince Caspian: A Must See

7) Halo-halo for the Rainy Days

8) Family Reunion

9) Lying is A By-product

10) Gladiators in My Dream

11) Turning a New Leaf

12) Is There a Bane to Being Brown?

13) Serve the People?

14) Lament of a Call Center Agent

15) A Mechalife

Bpath Counter